Hvlp Spray Gun 1.4mm 1.7mm 2.0mm | Spray Gun Hvlp Manual | Paint Spray Gun 101 W - Hvlp - Aliexpress

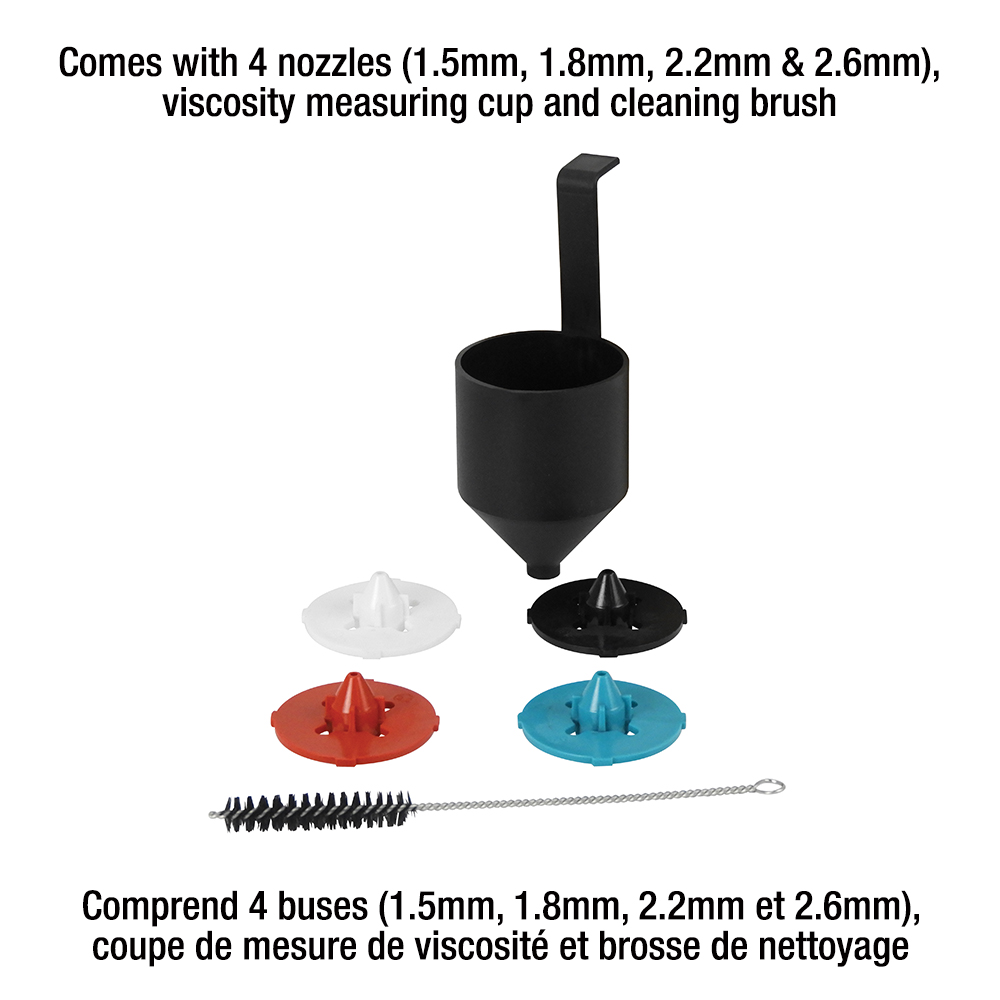

HVLP spray gun manual spray gun 1.3/1.5/1.8mm 400CC plastic pot gravity spray gun with spray gun accessories _ - AliExpress Mobile

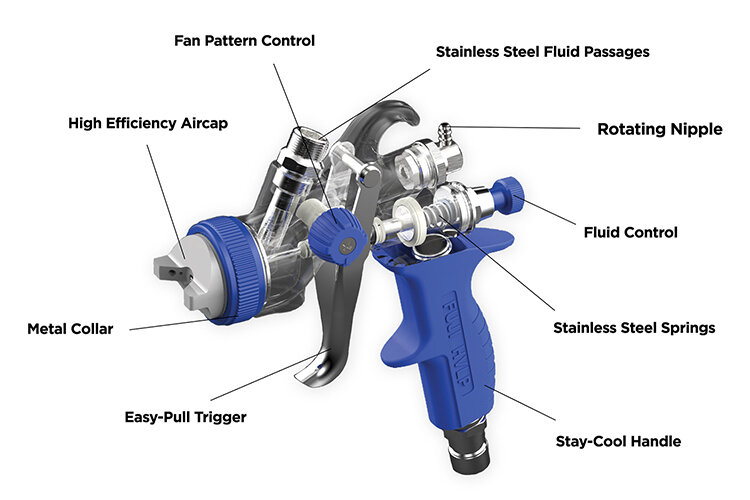

Yescom HVLP Spray Gun Stainless 1.0mm 1.4mm Nozzle for Car Auto Paint 2 Gun Kit Primer Gravity Feed 30-43psi - Walmart.com

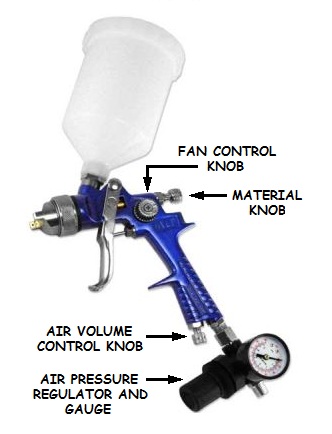

HVLP Spray Gun with 1.0mm Tip Air Spray Gun for Car Spraying Cup Gravity Feed Pain Gun for Car Prime,Furniture Surface Spraying,Wall Painting Include 125ml Capacity Cup Wrench Instruction Manual…… : Buy